Mckinsey has estimated that AI technologies in global banking can deliver up to $1 trillion of additional value every year. AI-powered solutions are designing innovative propositions and intelligent servicing that can embed without any flaws into the system.

Why Is AI Adoption Catching Up Fast in Lending?

Customers who were previously resisting embracing digital banking have evolved with the change. According to a report by BCG, mobile banking usage surged by 34% between February and June 2020, while there was a 12% decline during banking at branches.

Millennials are keen to go all digital. Incumbent banks are now adopting the vision of “AI-first” to gain a competitive advantage and stay relevant.

The impact of AI technologies is felt more than ever in our lives. From quick translation prompts to conversational interfaces, AI has its implications on transforming the full capability stack.

This induces core technology and data infrastructure, adds an engagement layer, and powers up decision-making. For better understanding, let us look into some of the relevant use cases:

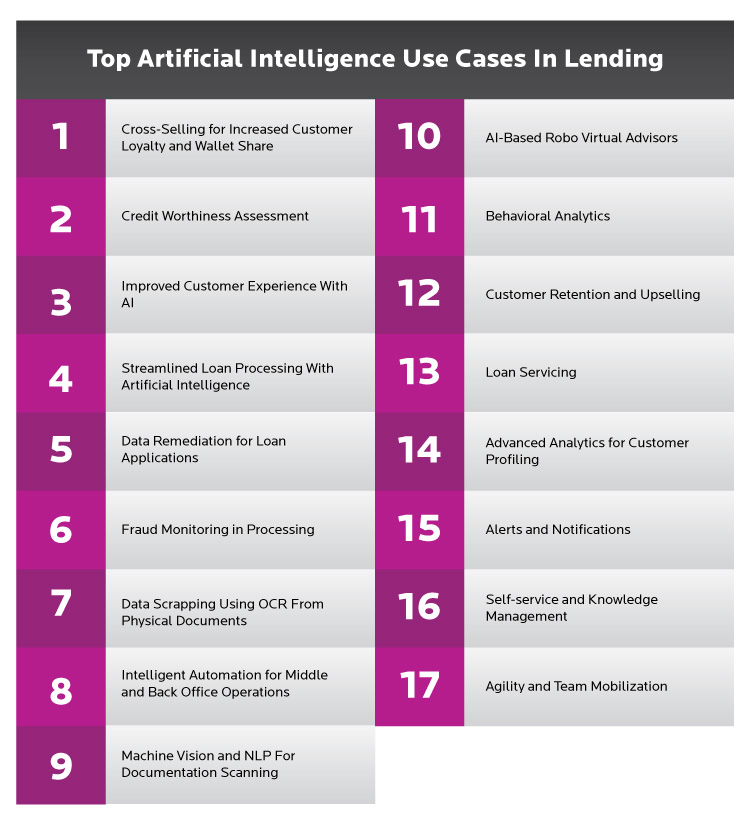

Top Artificial Intelligence Use Cases In Lending

AI Use Cases In Lending

- Cross-Selling for Increased Customer Loyalty and Wallet Share

- Credit Worthiness Assessment

- Improved Customer Experience With AI

- Streamlined Loan Processing With Artificial Intelligence

- Data Remediation for Loan Applications

- Fraud Monitoring in Processing

- Data Scrapping Using OCR From Physical Documents

- Intelligent Automation for Middle and Back Office Operations

- Machine Vision and NLP For Documentation Scanning

- AI-Based Robo Virtual Advisors

- Behavioral Analytics

- Customer Retention and Upselling

- Loan Servicing

- Advanced Analytics for Customer Profiling

- Alerts and Notifications

- Self-service and Knowledge Management

- Agility and Team Mobilization

1. Cross-Selling for Increased Customer Loyalty and Wallet Share

Customers today are looking for personalized services. No doubt, it has a significant impact on winning over customer confidence and loyalty. With the growing importance of curated, personalized services, data mining plays is imperative. AI-powered solutions are helping banks and financial lending institutions to access copious amounts of customer data and evaluate them to discern customer behavior.

Services more focused on the need of the customers generate more customer response and engagement. The growing use of customer data and increased computing power to analyze the leads to much more dynamic and insights, enabling customer-centric decision making. Digital channels now allow companies to fine-tune their marketing communication based on these analyses enhancing customer experience and creating more significant cross-selling opportunities.

Customers today rely on multiple vendors for a single service. Customer behavior, if studied adequately, would help businesses gather a chunk of information. Share of wallet would take it a step further, helping in customer retention. AI and automation intervene here and make the process seamless through intelligent data analysis.

2. Credit Worthiness Assessment

Commercial lending depends highly on the credit score of customers. Banks or commercial lending firms do not and will not lend to customers with a poor credit score.

Moving away from the traditional, new-age lenders are moving towards automated credit decisioning systems. Alternate scoring models are put in place to evaluate the creditworthiness and offer loan terms. The entire process of gauging the credit score and finally allowing the loan to the customers is made seamless through AI-based credit scoring.

The credit score of customers is pulled out and evaluated against a set standard. Customer’s eligibility is verified based on the customer bureau data. Up to 3 credit offers are displayed to eligible customers. Loans and credit cards are dispatched once the customer undertakes automated KYC and digital client onboarding, which otherwise can be a cumbersome process if done manually. AI integration makes it time-effective, leading to faster assessment and loan disbursal. This can be one of the many AI integration models.

Customers today expect a faster credit assessment and disbursal procedure. Rapid innovation and investment are happening in the commercial lending sector, serving customers at the right moment.

3. Improved Customer Experience With AI

As AI-enables richer and data-filled customer profiles, banks, and credit lending firms act as financial allies for their account holders. They are not just experts at providing plain vanilla customer products like loans and financial instruments, but they also intend to create a fulfilling customer experience. The application of AI in lending empowers banks to not settle for a B2B role but step up their capabilities towards protection and retention of customer relationships.

For starters, banks are already extracting data out of line items of transactions on current accounts or card statements to convert them into rich customer profiles. They act as the financial companions to the account holders, advising on savings, big-ticket purchases, offering financial literacy guidance, and assisting in critical decision-making. AI is helping them to make this much-needed value addition to its customers’ lives.

These digital lending platforms can leverage data to provide non-financial information to help banks notify specific customers about hot deals and offers that come with a good credit reputation and purchase decisions, providing customers with experiential banking and loan operations.