Instead, looking at the other side of the same coin, this massive COVID-19 outbreak has shown the gaps in current Lending processes – from the manual nature of the processes to lead to digital lending transformation and process automation. The industry is embracing rapid digital transformation and prepping to step into the new future.

The Surge in Lending Applications

Today, banks and financial lending institutions are at the forefront of economic disruption. With so many businesses and industries going through downtime, there has been a significant rise in credit demand.

Especially for small and medium-sized businesses, governments worldwide are launching special packages, and credits are made available. The US government has extended $4 trillion in grants and loans to support citizens and businesses in these difficult circumstances. Some of the core components of this package included the Paycheck Protection Program worth $670 billion. $360 billion in small business emergency loan authorization and many others. As pay cuts and job loss were the norms, the borrowing behavior of the millennials saw a significant shift.

Emergency funds to meet medical expenses and credit refinancing were the primary reasons to drive demand for loans. Banks are cutting out technology-focused towards managing the volumes of loan requests and processing.

Global loan loss provisions in the first half of 2020 surpassed all of 2019. The banks and lending institutions are anticipated to undergo a two-stage problem. First, there would be a severe credit loss crisis persisting through late 2021, which almost the entire lending industry is expected to survive. Second, in the middle of a muted global recovery, these lending institutions would encounter severe challenges with the ongoing operations. However, these financial institutions responded well to the initial crisis phase. With digital automation and a fresh set of technologies seeping into the cracks across the industries, a certain amount of stretching would be necessary across every vertical.

Overwhelmed Risk Managers

Many top banks are pacing towards public cloud and automated infrastructure to meet the growing demand. The turn of events and technology transformation is disruptive, leaving risk managers overwhelmed. To accelerate this transformation, the branch networks are being rewired and reconfigured. Taking a consistent digital approach to redeploy the workforce and reskill atscale would ensure smoother change.

Many banks and lending institutions are implementing agile solutions across work functions. Many banks are setting up speed control towers to manage operations.

Liquidity Crunch

In the wake of the pandemic, businesses are in dire need of cash. So far, a relatively sturdy financial system has offered short-term funding to most of the firms. According to a JPMorgan Chase report, by the end of March 2020, nearly $208 billion had been borrowed by large companies through revolver drawdowns. Revolvers act as a cushion to bridge temporary cash crunch. Will revolving lines be enough to shield the companies through a crisis? Chances are bleak!

Since the pandemic's economic impact still weighs heavy on the ecosystem, businesses and enterprises must likely move beyond their bank credit lines for an alternative liquid flows.

The State of Lending Industry

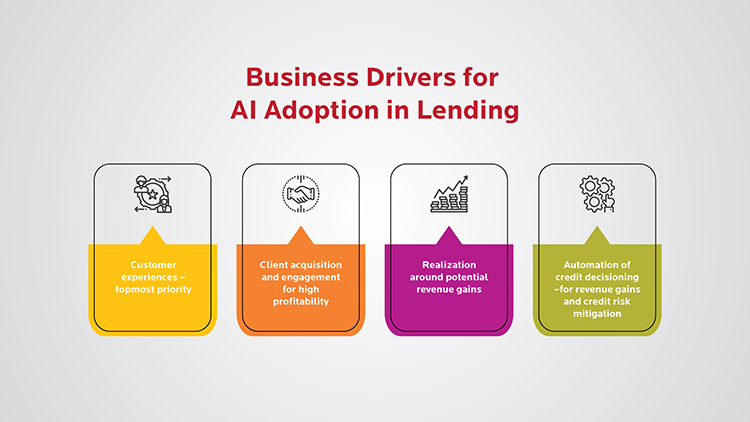

Trends and Adoption of AI in the Lending Ecosystem

Cost Optimization and Scalability For Growth

Considering the shifting scenarios, digital lending is becoming mainstream for banks and lending firms. Artificial Intelligence (AI) and Machine Learning (ML) offer a significant boost compared to only traditional statistical models. This innovation takes center stage when it comes to maintaining transparency and performance.

AI/ML models are more sensitive to data change and outliers, reducing manual intervention and scaling up the overall productivity.

Opex and RoI Considerations

Due to a reduced workforce and a higher degree of competitiveness, manual processes are slowly losing their shine. From customer onboarding to KYC, legal approvals, credit checks, banks spend 50 to 75% of the onboarding process cost. There's a complex process involved with multiple cross-functional teams that leads to higher operational costs and lower ROI.

A well-integrated AI, Automation, and ML models would enhance the entire lending process's efficiency, conjunction with other technologies like OCR and NLP.

Lending Cycle Time Reduction

Lenders can reduce loan processing from weeks to hours through the implementation of intelligent AI technology. The majority of the documentation work happens during the initial stages of loan processing, and these are highly time-consuming events. Enabling automation throughout the lending cycle, Artificial Intelligence in loan processing reduces the overall time spent on the mundane work processes.

Data Availability For Better Credit Decisioning

From assessing credit scores to identify eligibility to allocating the correct amount to the borrowers, keeping a tab on the borrower details, and assigning credit ratings to companies and (or) individuals require a considerable amount of expertise, investment, and time. Automated credit decisioning systems enabled through data-driven AI solutions reduce the time to evaluate a company's financial whereabouts and financial standing. It allows for closer monitoring of its activities and creditworthiness by looking at a broader set of data points for a smaller amount of time, generating faster credit scores.

Loan Processing Using Digital Data

In the well-connected digital nexus, manual processes give way to automation through AI in lending and loan processing. The manual nature of the similar systems would incur significantly higher costs for lenders reflected in expensive employee hours, time loss, and poor customer experience.

Fintech companies took to AI in loan processing, ensuring seamless approval and loan disbursal.

The Shift In AI Adoption In Large Banks

Credit risk digital transformation has propelled larger regulated entities to optimize credit risk for banks by using AI and ML models. These models help assess real credit risk, display a sophisticated framework for managing the entire lending process, give a clearer picture of the ratings and financial activities, and enhance efficiency.

Inability To Handle The High Loan Application Volumes

Banks and lending firms can use AI and ML models to step up rule-based underwriting. This enhancement leads to improving accuracy, primarily when it processes loan applications in bulk. The rising uncertainty has led to higher credit demands. Through these intelligent technology solutions, fintech and banks review customer data and creditworthiness. Through careful monitoring, banks can refine these models continuously. Underwriting automation, implementing credit decisioning processes, and digital lending help meet the unexpected demand surges, aiding resiliency of overall systems.

Trends - Adoption of AI in the Lending Ecosystem