So, what are the different AI & machine learning technologies available today, and how could insurers gain from them? Here is a quick overview:

- Data and textual analysis - This comprises the lion's share of use cases, with AI engines scanning personal information records and corporate audits to identify the possibility of risk. Based on the insights, P&C firms can customize their pricing policy or even deny insurance to an entity that it deems as a high-risk proposition. Today, with so much information available publicly online, insurers not using AI are clearly missing out.

- Image/object recognition - This is particularly relevant for commercial P&L, during the time of policy renewal. Firms do not have to send a representative to be physically present on site and take photos and videos of the insured property, it can be evaluated using AI and machine learning to detect changes. This will avoid errors arising from human fatigue, which is a common occurrence for insurance executives assessing properties at scale.

- Customer-facing chatbots - Customer support is a massive cost center for any business and this applies to insurance as well. Often, customers will insist on having a one-on-one conversation even if online documentation and FAQs are available. 24/7 customer support can positively impact customer loyalty levels – and AI & machine learning makes this possible without straining the workforce.

- Robotic process automation (RPA) - Backend activities in insurance are prime candidates for AI & machine learning implementation, unlocking significant efficiency gains. Claims collection is a one-such process where AI-led RPA can bring in accurate and adaptive automation capabilities. Combined with machine learning, automation engines will become more effective over time, resulting in an incremental uptick in profitability.

Insurers can use AI & machine learning in some of these ways to change operating models for the better. Areas such as robo-advisors are still at a nascent stage, with plenty of promise in the long term.

AI In Insurance | Machine Learning In Insurance – Use Cases

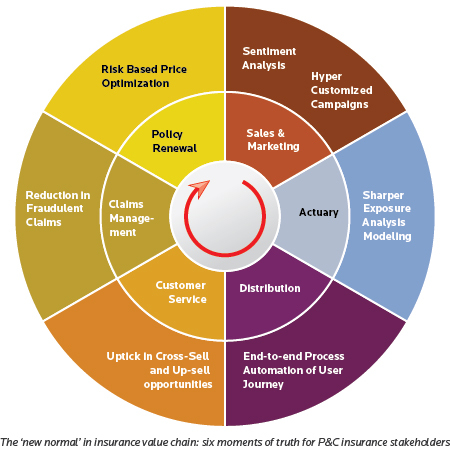

These technologies could play a role at six moments of truth for P&C insurance stakeholders. Here's how an

AI-led insurance value chain would look:

- Marketing/sales - AI can help hyper-customize marketing initiatives based on audience segmentation and sentiment analytics.

- Insurance actuary - AI can create more accurate exposure analysis models, specifically in trends-based areas such as catastrophe modeling.

- RPA in distribution - Processes like agent support, form filling, performance evaluations, etc., can be fully automated.

- Customer servicing - As mentioned, chatbots can take over query resolution and help upsell/cross-sell to existing customers.

- Claims management - FNOL reports can be analyzed by an AI engine to pursue investigation, curbing the risk of fraudulent claims.

- Renewals/reinsurance - AI can assist in price optimization, negotiating the best value based on risk.